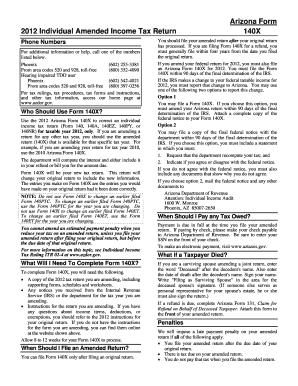

Get Amend Arizona State Tax Return 2012 140x Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Amend Arizona State Tax Return 2012 140x Form online

This guide provides clear and detailed instructions on how to electronically complete the Amend Arizona State Tax Return 2012 140x Form. Whether you are making corrections to your original tax return or updating your information, this guide will assist you in navigating the process smoothly.

Follow the steps to fill out the Amend Arizona State Tax Return 2012 140x Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name, address, and Social Security Number (SSN). Ensure your SSN is accurate to avoid processing delays.

- Select your filing status by checking the appropriate box on the form.

- Indicate your residency status by checking the corresponding box (full year resident, nonresident, etc.).

- Provide your federal adjusted gross income as reported on your original return.

- Fill in the corrected amounts for additions to income in the designated fields.

- List your exemptions in the appropriate sections, ensuring to include any changes compared to your earlier return.

- Calculate your Arizona adjusted gross income by subtracting the permitted subtractions from your total income.

- Complete the tax calculation, following the provided tax tables for the year 2012.

- If applicable, specify any credits you are eligible for, including necessary forms and supporting documentation.

- Review all entries for accuracy before finalizing. Math errors can result in processing delays.

- Save changes, download, print, or share the form as required based on your submission needs.

Take action today and complete your Amend Arizona State Tax Return 2012 140x Form online.

To fill out the 1040X amended return, start by gathering your original tax return and any supporting documents. Follow the instructions on the form closely, ensuring you report new or corrected information accurately. Use the uslegalforms platform to find helpful templates and tips for completing your 1040X effectively, ensuring that your amendments are properly documented.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.