Loading

Get T2125 Tax Form: Declare Income And Expenses From A Business Or...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2125 Tax Form: Declare Income And Expenses From A Business Or Profession online

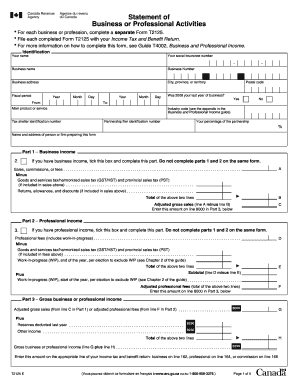

Completing the T2125 Tax Form is essential for individuals reporting income and expenses from a business or profession in Canada. This guide provides clear, step-by-step instructions on how to accurately fill out the form online, ensuring compliance with tax regulations.

Follow the steps to successfully complete the T2125 Tax Form online.

- Click 'Get Form' button to obtain the T2125 Tax Form and open it in your chosen editor.

- In the Identification section, enter your name, social insurance number, business name, business number, and address details. Make sure to note the fiscal period, specifying the year, month, and day for the start and end of the period.

- Indicate whether 2008 was your last year of business by ticking the appropriate box. Fill in the main product or service along with the corresponding industry code.

- If you have business income, tick the specified box and complete Part 1 by reporting sales, commissions, or fees. Apply any deductions for taxes included in sales and report returns or allowances.

- If applicable, complete Part 2 for professional income, detailing professional fees and making necessary tax adjustments.

- Proceed to Part 3 to calculate your gross business or professional income by summing gross profits from previous sections and reporting them accurately.

- If you have business income, complete Part 4 by reporting costs of goods sold and calculating gross profit.

- In Part 5, outline all business expenses, including advertising, meals, rent, and others listed. Sum these to determine your net income or loss before adjustments.

- Fill out Part 6, where you will report any business-use-of-home expenses and derive your final net income or loss for submission.

- Once all fields are completed, save your changes, then download, print, or share the form as necessary.

Complete your T2125 Tax Form online today to ensure accurate reporting of your business income and expenses.

To report your business income, complete the T2125 Tax Form: Declare Income And Expenses From A Business Or, including all earnings from your business activities. Ensure you accurately calculate and report your income to avoid penalties. Using platforms like uslegalforms can help streamline this process for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.