Loading

Get Nmfl 4506 - Request For Transcript Of Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NMFL 4506 - Request For Transcript Of Tax Form online

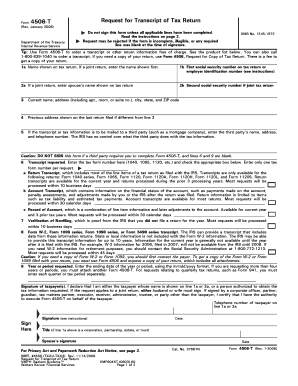

The NMFL 4506 - Request For Transcript Of Tax Form is a key document for individuals seeking to obtain a transcript of their tax return information from the IRS. This guide provides a step-by-step approach to assist users in completing the form online efficiently and correctly.

Follow the steps to accurately fill out the NMFL 4506 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In line 1a, enter the name as it appears on your tax return. For joint returns, provide the name of the primary filer first.

- In line 1b, enter the first social security number from the tax return. If this request is for a business return, use the employer identification number instead.

- If applicable, in line 2a, indicate the spouse's name as it appears on the joint tax return.

- In line 2b, enter the second social security number if filing a joint return.

- Fill in your current address in line 3, ensuring to include any apartment or suite numbers.

- If you have moved since your last return, provide your previous address in line 4.

- If sending the transcript to a third party, complete line 5 with their name, address, and phone number.

- In line 6, specify the transcript you are requesting by entering the tax form number (such as 1040, 1065) and check the appropriate box for the type of transcript needed.

- Complete line 9 by entering the year or period requested, ensuring the format is mm/dd/yyyy. If requesting more than four years, attach another form.

- At the end of the form, sign and date where indicated, ensuring your signature matches the name on line 1a or 2a.

- Finally, save your changes, download a copy of the form, and print or share it as necessary.

Complete your documents online to streamline your requests and ensure accurate submissions.

To obtain a tax transcript immediately, you can use the IRS online service by filling out the NMFL 4506 - Request For Transcript Of Tax Form. This method provides instant access to your transcript if you meet the necessary requirements. Ensure you have your personal details ready for verification. For additional help, consider leveraging the resources at US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.