Loading

Get Bir Form 2107 Application For Compromise Settlement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 2107 Application For Compromise Settlement online

This guide provides detailed instructions on completing the Bir Form 2107 Application For Compromise Settlement online. Whether you are familiar with tax forms or a first-time user, this step-by-step overview will help simplify the process for you.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

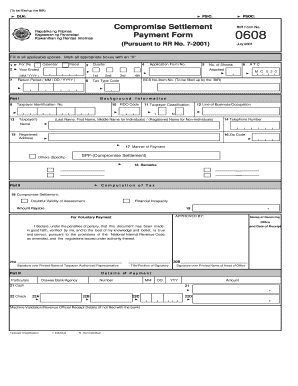

- Begin filling out the required fields. In the first section, enter your DLN (Document Locator Number) and PSIC (Primary Standard Industrial Classification), ensuring accuracy for identification purposes.

- Mark the appropriate boxes, indicating whether this application pertains to a calendar or fiscal year and specify the return period using the MM/DD/YYYY format.

- In Part I, provide your Taxpayer Identification Number (TIN) and fill in your name (or registered name for non-individuals), telephone number, and registered address, including the zip code.

- Indicate the manner of payment by selecting 'Compromise Settlement' or other applicable options. Be sure to specify if you select 'Others'.

- Proceed to Part II and compute the tax, providing justifiable reasons such as 'Doubtful Validity of Assessment' or 'Financial Incapacity' for your application.

- Complete the signature section, ensuring the document is signed by either the taxpayer or an authorized representative, along with their printed name and title/position.

- Finally, review all the information for accuracy, save your changes, and then you can download, print, or share the completed form as needed.

Complete your BIR forms online with confidence today!

Related links form

BIR Form 2000 is designed for the payment of documentary stamp taxes, while BIR Form 2000 OT is specifically for the payment of other types of taxes that fall outside the normal categories. Understanding the distinctions between these forms is crucial for compliance. If managing these forms feels overwhelming, explore the benefits of the BIR Form 2107 Application For Compromise Settlement for assistance with tax liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.