Get Sales Validation Questionnaire Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales Validation Questionnaire Form online

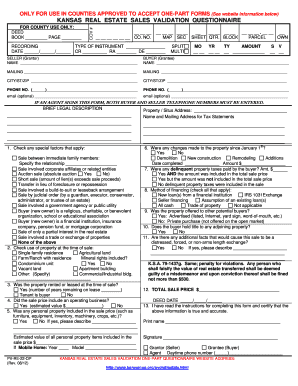

Completing the Sales Validation Questionnaire Form online is a crucial step in ensuring a smooth real estate transaction. This guide provides clear and detailed instructions to help you successfully fill out each section of the form, making the process accessible for all users.

Follow the steps to complete the questionnaire effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the county-specific details in the sections labeled 'FOR COUNTY USE ONLY.' Fill in the deed book and page numbers, and any applicable county numbers.

- Provide the recording type and date of the transaction. This includes entering details like the month, year, and any other relevant information.

- Fill in the seller's name (grantor) and buyer's name (grantee) in the designated fields. Ensure to include mailing addresses for both parties.

- Enter the legal description of the property briefly but accurately in the respective field.

- Check any special factors that apply to your sale in the first section of the questionnaire. Specify relationships if the sale involves immediate family.

- Indicate the property's use at the time of sale by selecting appropriate options from the list provided. You may check multiple boxes if applicable.

- Answer whether the property was rented or leased at the time of sale, and if applicable, state the number of years remaining on the lease.

- Provide details regarding any personal property included in the sale, along with its estimated value.

- Check for any changes made to the property since January 1st, detailing the nature and cost of these changes.

- Indicate how the sale price was affected by any delinquent taxes, if applicable.

- Select the financing methods applied to the purchase from the list, checking all that are relevant.

- Confirm whether the property was offered to other potential buyers and provide details of the advertising methods used.

- Answer questions regarding adjoining titles and any special circumstances surrounding the sale.

- Total the sale price and provide the deed date.

- Read the instructions for completing the form, sign where indicated, and include a daytime phone number for follow-up if necessary.

- Finally, save changes, and choose to download, print, or share the completed form as required.

Take the next step in your real estate transaction by completing the Sales Validation Questionnaire Form online today.

To create a valid real estate sale, several key elements are necessary, including a legally binding contract, a clear title, and compliance with local laws. Additionally, both buyer and seller must be of sound mind and have the legal capacity to enter into the contract. Using the Sales Validation Questionnaire Form can help gather and organize the necessary information to meet these requirements effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.