Get Writable 2012 Arizona 140nr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the writable 2012 Arizona 140nr form online

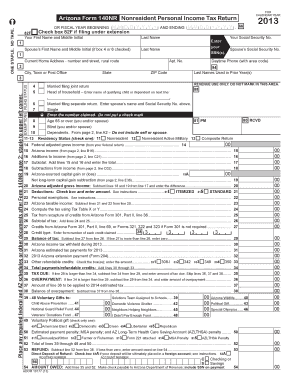

Filling out the writable 2012 Arizona 140nr form online is an essential step for nonresidents to report their income and taxes accurately. This guide will provide you with a clear, step-by-step process to navigate each section of the form efficiently.

Follow the steps to accurately complete your Arizona 140nr form online.

- Click 'Get Form' button to obtain the writable 2012 Arizona 140nr form and open it in the appropriate editor.

- Enter your first name, middle initial, and last name in the designated fields at the top of the form.

- If filing under extension, check the box marked 82F.

- Provide your Social Security Number (SSN) in the space provided for yourself and your spouse, if applicable.

- Fill in the current home address, including your street number, rural route, apartment number, city, state, and ZIP code.

- Select your filing status by checking one of the options provided: married filing jointly, head of household, married filing separately, or single.

- Claim exemptions by entering the number of dependents and details like age or disability status as instructed in the corresponding fields.

- Calculate your federal adjusted gross income based on your federal return and enter it in the provided space.

- Complete sections for Arizona income, subtractions, deductions, and credits as applicable.

- At the end of the form, review your entries, and then save your changes. You can also download, print, or share the completed form as needed.

Complete your writable 2012 Arizona 140nr form online today to ensure accurate reporting of your income and taxes.

Arizona income tax forms, such as the Writable 2012 Arizona 140NR Form, are available from several reliable sources. You can find them on the Arizona Department of Revenue's website, which offers all necessary forms for download. Furthermore, US Legal Forms provides a user-friendly platform to access and fill out these forms online, ensuring you have the correct documents at your fingertips.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.