Loading

Get Tax Exempt Formsuddenlinkcom

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Exempt Formsuddenlinkcom online

This guide provides a clear and supportive overview of how to complete the Tax Exempt Formsuddenlinkcom online. By following these steps, you can ensure that your application is filled out correctly, minimizing potential issues related to tax exemptions.

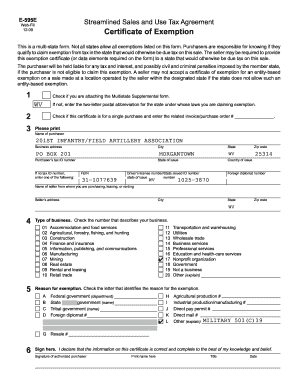

Follow the steps to complete the exemption certificate correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by checking if you need to attach the Multistate Supplemental form. If not, enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

- Indicate if this certificate is for a single purchase by checking the corresponding box and enter the related invoice or purchase order number.

- Fill out the name of the purchaser in the designated field, ensuring accuracy for your documentation.

- Enter the business address, including the city, state, and zip code. Ensure the address reflects the physical location of the purchaser.

- Provide the purchaser’s tax ID number. If no tax ID number is available, enter an alternative identification such as a driver's license number.

- Supply the name and address of the seller from whom the purchase is being made, including city, state, and zip code.

- Select the type of business from the provided options by circling the appropriate number that describes your business.

- Indicate the reason for claiming the exemption by checking the corresponding letter that applies to your situation.

- Complete the signature section, ensuring that the signature is from an authorized purchaser, along with their printed name, title, and date.

Complete your documents online to ensure a smooth and efficient process.

To obtain a sales tax exemption certificate in North Carolina, you need to fill out the appropriate application form provided by the state. You can find the necessary forms and instructions at Tax Exempt Formsuddenlinkcom. Completing this process correctly will help you secure your exemption status efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.