Get Form St-13 Small Business Energy Exemption Certificate For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-13 Small Business Energy Exemption Certificate online

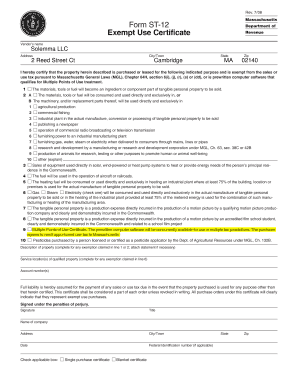

Filing the Form ST-13 Small Business Energy Exemption Certificate online is a straightforward process designed to assist businesses in claiming exemptions from sales or use tax in Massachusetts. This guide will walk users through each section of the form, ensuring a smooth completion.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the vendor’s name. This should include the complete legal name of the business or individual offering the products or services.

- Enter the address details. Include the street address, city or town, state, and zip code of the vendor.

- In the certification section, select the purpose of the exemption by checking the appropriate box. Each box corresponds to specific categories such as agricultural production, commercial fishing, or industrial manufacturing.

- If using the exemption for gas, steam, or electricity, provide additional information in the fields for service locations and account numbers.

- Fill out the description of the property purchased or leased, including any necessary details to support the exemption claim.

- Include your signature and the date of signing to validate the certificate. Ensure that your title and name of the company are completed.

- Indicate whether this is a single purchase or blanket certificate by checking the appropriate box.

- Review all the filled fields for accuracy and completeness.

- Once everything is in order, save your changes, download, print, or share the completed form as needed.

Complete your documentation online to take advantage of available tax exemptions today.

To apply for an Alabama sales tax exemption certificate, you need to complete the appropriate application form available through the Alabama Department of Revenue. You will provide your business information, the type of exemption you seek, and any supporting documentation required. Once you submit the application, expect a review process before receiving your exemption certificate. For a smooth application process, consider leveraging resources from US Legal Forms to guide you through the steps.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.