Loading

Get Withdrawal Form Accuplan V1 06152010 - Self Directed Ira

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withdrawal Form Accuplan V1 06152010 - Self Directed IRA online

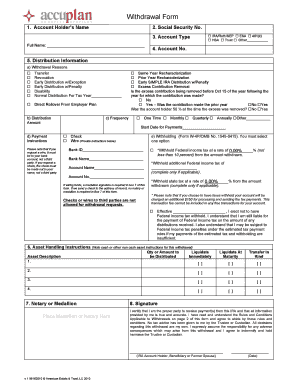

This guide provides a comprehensive overview of the Withdrawal Form Accuplan V1 06152010 for Self Directed IRAs. By following these step-by-step instructions, you will be able to easily complete and submit the form online.

Follow the steps to fill out the Withdrawal Form Accuplan V1 06152010 online.

- Press the ‘Get Form’ button to download the Withdrawal Form Accuplan V1 06152010 and open it in your preferred digital editor.

- Enter the account holder's name on the form’s designated line for identification.

- Provide your Social Security number in the corresponding field. Indicate your account type by checking the appropriate box (IRA, Roth, SEP, etc.) before proceeding.

- Fill in your full account number accurately to ensure proper processing of your withdrawal request.

- In the distribution information section, choose the reason for your withdrawal by selecting the checkbox next to the relevant option (e.g., transfer, normal distribution).

- Specify the amount you wish to withdraw and select from the options for distribution frequency (one-time, monthly, etc.). Fill in the start date if applicable.

- Provide clear payment instructions, whether you prefer a check or bank wire, noting that check payments must be made out to you.

- Complete the withholding section by selecting an option regarding federal and state taxes. Specify the tax rates you wish to apply if you are opting to withhold taxes.

- Detail any asset handling instructions if you are liquidating or transferring assets. Indicate quantities or amounts as necessary.

- Sign the form in the signature section, confirming that all provided information is accurate and that you understand the associated rules and conditions.

- Finally, save your changes, and you may choose to download, print, or share the completed form as required.

Complete your Withdrawal Form Accuplan V1 06152010 online today to ensure a smooth withdrawal process.

9. Early withdrawals: With Roth IRAs, you can withdraw your contributions (but not your earnings) at any time, for any reason, with no tax or penalty. Withdrawals are tax and penalty-free after age 59½, provided the account is at least five years old.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.