Loading

Get It 215 Form 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-215 Form 2015 online

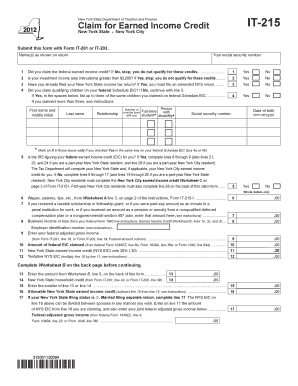

Filling out the IT-215 Form 2015, which is used to claim the Earned Income Credit in New York State, can be a straightforward process if you follow the right steps. This guide provides a clear, step-by-step approach to help you accurately complete the form online.

Follow the steps to successfully complete your IT-215 Form 2015 online.

- Press the ‘Get Form’ button to access the IT-215 Form 2015. This action will open the form in your preferred online editor.

- Begin by entering your name(s) as listed on your tax return along with your social security number in the specified fields.

- Answer the first question regarding whether you claimed the federal earned income credit. If you select 'No,' you do not qualify for the New York credits.

- Proceed to indicate if your investment income is greater than $3,200. Selecting 'Yes' will lead to ineligibility for credits.

- Confirm if you have already filed your New York State income tax return. If you have, ensure to file an amended tax return as necessary.

- If you claimed qualifying children on your federal Schedule EIC, list up to three children’s names, relationships, dates of birth, and social security numbers as instructed.

- Indicate whether the IRS is calculating your federal earned income credit for you. Based on your answer, proceed to the correct lines.

- Fill in your federal adjusted gross income as directed, and enter the amount of federal EIC claimed from the relevant federal forms.

- Calculate the New York State earned income credit based on the instructions provided, ensuring to complete all necessary calculations.

- For part-year residents, follow the specific instructions and complete lines 18 through 26 as applicable to determine excess New York State earned income credit.

- Once all fields are filled out, review your entries for accuracy, and use the options available to save your changes, download a copy, print, or share the completed form.

Start filling out your IT-215 Form 2015 online today to ensure you receive your earned income credit.

The purpose of the Earned Income Credit (EIC) is to support low-to-moderate income working individuals and families by reducing their tax liability. This credit is designed to encourage employment and alleviate poverty by providing additional financial resources. By accurately filing the IT 215 Form 2015, you can access this crucial financial support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.