Loading

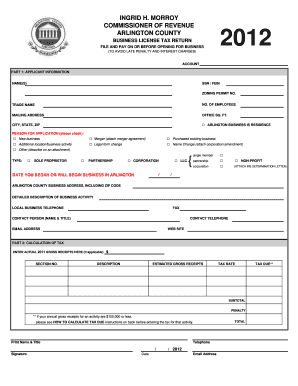

Get Tax Return Arlington

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return Arlington online

Filing your Tax Return Arlington online is a crucial step for any business operating within Arlington County. This guide will help you understand each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete your Tax Return Arlington online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Provide your applicant information in Part 1, including your name, social security number or federal employer identification number, zoning permit number, trade name, the number of employees, and mailing address. Make sure to include your office square feet and the local business's complete address.

- Select your reason for application by checking the appropriate box. Options include 'new business', 'additional location/business activity', 'merger', 'legal form change', or 'purchased existing business'. If none apply, check 'other' and provide a description.

- Indicate your business type by selecting one of the options provided, such as 'sole proprietor', 'partnership', 'corporation', 'LLC', or 'non-profit'. If applicable, attach the IRS determination letter for non-profits.

- Enter the date you began or will begin business in Arlington.

- Provide a detailed description of your business activity, including your local business telephone, fax number, contact person's name and title, their contact telephone number, email address, and website.

- Move to Part 2 for the calculation of tax. Enter your actual gross receipts from 2011 (if applicable) and estimate your gross receipts for 2012. Be sure to include the tax rate applicable to your type of business activity, then calculate the subtotal, any penalties, and the total tax due.

- Ensure the printed name, title, telephone number, and signature of the applicant are included, along with the date and email address.

- Once the form is completed, save the changes. You can then download, print, or share the form as needed.

Complete your Tax Return Arlington online today to ensure compliance and avoid penalties.

The easiest way to get your tax refund is to utilize online tax preparation services that guide you through the filing process. In Arlington, platforms like US Legal Forms simplify this experience, making it user-friendly and efficient. By choosing to e-file and opt for direct deposit, you can also ensure a quicker turnaround on your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.