Loading

Get 2008 Form 1099-b - Rbc Dominion Securities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

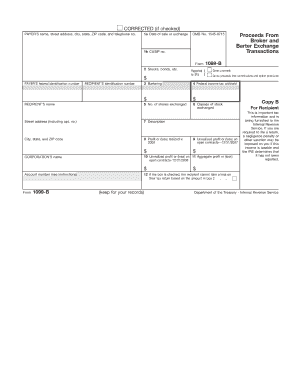

How to fill out the 2008 Form 1099-B - RBC Dominion Securities online

This guide provides a comprehensive overview of how to accurately complete the 2008 Form 1099-B for RBC Dominion Securities online. Users with varying levels of experience will find detailed instructions and guidance to help them fill out the form correctly.

Follow the steps to complete your 2008 Form 1099-B online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the payer’s name, street address, city, state, ZIP code, and telephone number in the designated fields. Ensure this information is accurate to avoid any delays in processing.

- Fill out box 1a with the date of sale or exchange. This date is critical for reporting the transaction correctly.

- In box 1b, input the CUSIP number, which is essential for identifying the specific securities involved in the transaction.

- Report any proceeds from stocks, bonds, and other transactions in box 2. Specify whether you are reporting gross proceeds or net proceeds after commissions.

- If applicable, indicate any bartering transactions in box 3. Include the cash received and fair market value of property or services obtained.

- In box 4, report any federal income tax withheld from your proceeds. This amount should be included in your tax return as paid tax.

- Complete box 5 with the number of shares exchanged during the transactions reported.

- List the classes of stock exchanged in box 6. This information helps clarify the nature of the transaction.

- Describe the nature of securities or transactions in box 7, providing a brief yet clear description.

- Report the profit or loss realized in 2008 in box 8. Accurate reporting is vital for tax calculations.

- Input the unrealized profit or loss on open contracts as of December 31, 2007, in box 9.

- For box 10, indicate the unrealized profit or loss on open contracts held on December 31, 2008.

- Finally, in box 11, provide the aggregate profit or loss calculations based on the previously reported boxes for your records.

- Once completed, save your changes. You may then download, print, or share the form according to your needs.

Start filling out your documents online today for a smooth and efficient process.

Yes, you need to send a copy of the 2008 Form 1099-B - RBC Dominion Securities to the IRS. Your brokerage firm will typically handle this for you, but you must ensure that you report the same information on your tax return. This step is crucial to avoid discrepancies between your records and what the IRS has on file. By being diligent, you can prevent potential issues with your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.