Get Form 8736

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8736 online

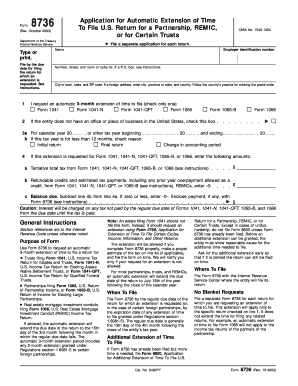

Filling out Form 8736 is a straightforward process that allows users to request an automatic extension of time to file U.S. tax returns for partnerships, REMICs, and certain trusts. This guide will provide you with clear, step-by-step instructions to complete the form easily and accurately.

Follow the steps to successfully complete Form 8736 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Provide your entity's name in the designated field.

- Enter the employer identification number (EIN) in the corresponding field.

- Fill in the street address along with the room or suite number. If a P.O. box is used, refer to the instructions.

- Complete the city or town, state, and ZIP code fields. For foreign addresses, include the city, province, or state, and country.

- Indicate which form you are requesting an extension for by checking only one box on line 1.

- Select the tax year on line 3a and indicate if the year is less than 12 months by checking the appropriate reason on line 3b.

- For lines 4a through 4c, enter the tentative total tax expected, any refundable credits, and compute any balance due as instructed.

- Review your entries for accuracy, then determine if any payment needs to be enclosed with the form.

- Once complete, save your changes, download the form for your records, and print or share it as needed.

Complete your Form 8736 online today to ensure a timely filing and maintain compliance.

To obtain a copy of your tax extension letter, you can contact the IRS directly, or check your email if you filed electronically. If you used Form 8736 to file for an extension, keep a copy for your records as it serves as proof of your request. Additionally, consider using US Legal Forms to create and manage your tax documents efficiently. This platform can help ensure you keep track of all necessary forms and deadlines.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.