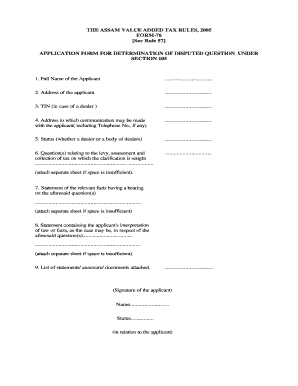

Get The Assam Value Added Tax Rules, 2005 Form-76 See Rule 57 Application Form For Determination Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the THE ASSAM VALUE ADDED TAX RULES, 2005 FORM-76 See Rule 57 APPLICATION FORM FOR DETERMINATION OF online

Navigating the process of filling out the Assam Value Added Tax Rules, 2005 Form-76 can feel complex. This guide provides clear, step-by-step instructions to help you accurately complete the application for the determination of disputed questions under Section 105.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the full name of the applicant in the designated field. Ensure that it is accurate as this will be used for all official communications.

- Provide the complete address of the applicant. This information is necessary for any correspondence related to the application.

- If applicable, include the Taxpayer Identification Number (TIN) for dealers. This helps verify your status as a registered dealer.

- Indicate the address for communication purposes. If a telephone number is available, include it to facilitate quicker communication.

- Specify the status of the applicant. Clearly state if the applicant is a dealer or representing a body of dealers.

- List the question(s) for which clarification is sought regarding levy, assessment, and collection of tax. If necessary, attach a separate sheet providing additional details.

- Provide a statement of relevant facts that pertain to the questions asked. This section should clearly outline any critical information that influences the inquiry.

- Include the applicant's interpretation of the law or relevant facts concerning the posed questions. Attaching thorough explanations can assist the authorities in making a determination.

- Compile a list of all statements, annexures, or documents that are attached to the application. This ensures that all supporting materials are recognized.

- Sign the application and input your name along with your status in relation to the application.

- Complete the verification section, affirming that the provided information is accurate and that the applicant is competent to verify the application.

- After verifying all details are accurate, users can save changes, download, print, or share the completed form as needed.

Start filling out your application online today to ensure your queries are addressed promptly.

Yes, VAT is applicable in Assam as outlined in THE ASSAM VALUE ADDED TAX RULES, 2005 FORM-76 See Rule 57 APPLICATION FORM FOR DETERMINATION OF. This tax applies to goods and services sold within the state, making it crucial for businesses to register and comply with VAT regulations. By doing so, businesses can ensure they meet legal requirements and avoid penalties. For assistance in navigating these requirements, consider using platforms like uslegalforms, which provide resources and solutions tailored to your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.