Get St 121 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 121 form online

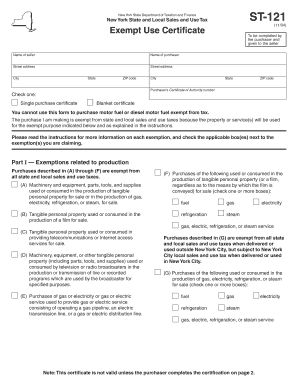

Filling out the St 121 form online can be a straightforward process when guided adequately. This form is utilized for exempt purchases in relation to New York State and Local Sales and Use Tax. Follow the steps below to complete the form accurately and efficiently.

Follow the steps to complete the St 121 form online.

- Press the ‘Get Form’ button to download and open the form in your preferred digital format.

- Begin by filling in the seller's name in the designated field provided at the top of the form.

- Next, enter the purchaser's name and complete the street address details accurately, ensuring all information is up to date.

- In the 'City,' 'State,' and 'ZIP code' fields, provide the relevant location information for the purchaser.

- Enter the purchaser's Certificate of Authority number, which authorizes the purchaser to make exempt purchases.

- Select the appropriate checkbox to indicate whether you are submitting a single purchase certificate or a blanket certificate.

- In Part I, check the applicable exemption categories related to production for which the exemption is claimed, ensuring to read the instructions for each exemption.

- Continue to Part II, indicating any services that may be exempt from tax based on the guidelines provided.

- In Part III, select any additional exemptions relevant to your purchase, checking all applicable boxes.

- Complete the certification statement by providing your signature, typing your name clearly, and including the date of completion.

- Finally, save the completed form. You may also choose to download, print, or share the form as necessary.

Complete your St 121 form online today to ensure your tax-exempt purchases are processed efficiently.

The main difference between the ST-120 and ST-121 forms lies in their purpose. The ST-120 form is typically used for resale exemptions, while the ST-121 Form is specifically for claiming sales tax exemption for certain purchases. Understanding which form to use is crucial for compliance. For clarity and support, US Legal Forms can provide insights into these forms and help you choose the right one for your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.