Loading

Get Maryland Form 502e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maryland Form 502e online

Filling out the Maryland Form 502e online is a straightforward process that helps you request an extension to file your personal income tax return. This guide provides clear, step-by-step instructions to navigate through the form efficiently.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your Social Security number in the designated field, followed by your first name, middle initial (if applicable), and last name.

- If applicable, fill in your spouse’s Social Security number, first name, middle initial, and last name in the provided fields.

- Next, complete your address by entering the number and street information, city or town, state, and ZIP code.

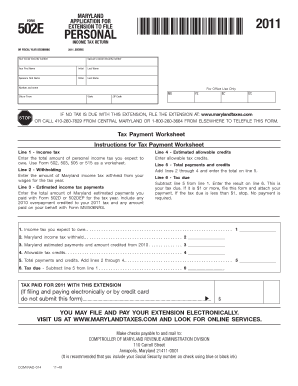

- Proceed to the Tax Payment Worksheet. Start by entering the total income tax you expect to owe as instructed on line 1.

- On line 2, input the total amount of Maryland income tax that has been withheld from your wages during the tax year.

- Line 3 requires you to enter the total amount of Maryland estimated payments made, including any overpayment credited from the previous tax year.

- For line 4, list any allowable tax credits you may have.

- Add the amounts from lines 2, 3, and 4 to obtain the total for line 5.

- Finally, compute the tax due by subtracting the total from line 5 from the amount on line 1. Enter this result on line 6.

- If the tax due is $1 or more, ensure you attach your payment (if applicable) before proceeding.

- Once all fields are correctly filled, save your changes. You can then download, print, or share your completed Form 502e as necessary.

Complete your Maryland Form 502e online today to ensure timely filing!

If you own personal property in Maryland, you may be required to file a personal property tax return. This typically includes businesses and individuals who own tangible assets such as machinery and equipment. For guidance on filing, you can refer to resources available on the uslegalforms platform, which can help you navigate the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.