Get Form 4626 - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4626 - Internal Revenue Service online

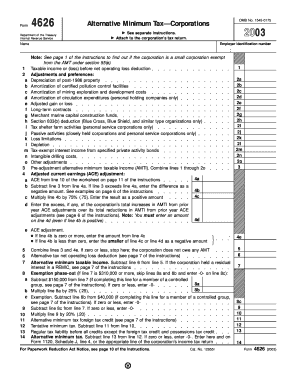

Filling out the Form 4626 is an important task for corporations that may owe Alternative Minimum Tax (AMT). This guide provides clear instructions on how to complete the form online, ensuring that users have all the information they need for a successful submission.

Follow the steps to complete Form 4626 efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Provide the corporation's name and employer identification number in the designated fields at the top of the form.

- Report the taxable income or loss before net operating loss deduction on line 1.

- Complete the adjustments and preferences section, which includes various items like depreciation of post-1986 property and amortization costs. Fill out each line carefully based on the corporation’s financial activities.

- Calculate the pre-adjustment alternative minimum taxable income (AMTI) by combining the values from line 1 and the adjustments previously completed.

- Enter the adjusted current earnings (ACE) adjustment. Follow the steps to derive the amounts needed for lines 4a through 4d.

- Combine lines 3 and the ACE adjustment from line 4e to determine if the corporation owes any AMT. If the result is zero or less, no further action is needed.

- If applicable, complete the exemption phase-out calculations, including lines 8a through 8c, to determine the exemption eligibility.

- Calculate lines 9 through 12, where you determine the tentative minimum tax and account for any credits.

- Finalize the calculation of the alternative minimum tax by subtracting the regular tax liability from the tentative minimum tax on line 14.

- Once all fields are complete and verified, save any changes, download a copy of the form, and print or share it as necessary.

Start filling out your Form 4626 online today for a smooth filing experience.

Form 4626 - Internal Revenue Service is a tax form used to claim a credit for the alternative minimum tax (AMT) on corporations. This form helps corporations determine their tax liability based on alternative minimum tax rules. Understanding Form 4626 is essential for ensuring compliance with IRS regulations and optimizing your tax strategy. To obtain and fill out this form, consider using US Legal Forms for a user-friendly experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.