Get Form 402 See Rule 401b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 402 See Rule 401b online

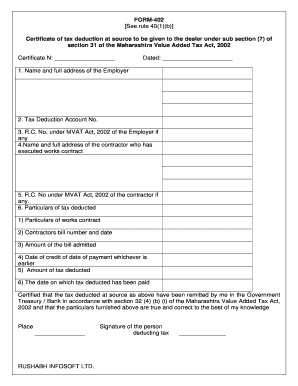

Filling out the Form 402 See Rule 401b is an essential process for documenting tax deductions at source under the Maharashtra Value Added Tax Act, 2002. This guide will provide you with clear, step-by-step instructions to successfully complete the form online.

Follow the steps to accurately complete the Form 402 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing environment.

- In the first section, enter the name and full address of the employer in the designated fields. Ensure that the information is accurate and complete.

- Next, provide the Tax Deduction Account Number (TAN) for the employer in the appropriate field.

- If applicable, input the Registration Certificate Number (R.C. No.) under the MVAT Act, 2002 for the employer.

- In the following section, enter the name and full address of the contractor who executed the works contract.

- If available, provide the Registration Certificate Number (R.C. No.) under the MVAT Act, 2002 for the contractor.

- Detail the particulars of tax deducted by filling out the following fields: 1) Particulars of works contract, 2) Contractor’s bill number and date, 3) Amount of the bill admitted, 4) Date of credit or date of payment, whichever is earlier, 5) Amount of tax deducted, and 6) The date on which tax deducted has been paid.

- At the bottom of the form, certify that the particulars provided are true and correct to the best of your knowledge. Sign in the designated area.

- Finally, input the date and place of completion of the form. You can then save changes, download, print, or share the form as needed.

Complete your documents online to ensure accuracy and compliance.

The Fair Political Practices Commission Form 700 is a financial disclosure form required in California. This form helps ensure transparency among public officials and candidates by detailing their financial interests. By completing Form 402 See Rule 401b, you can gain insights into the compliance requirements related to these disclosures. For those navigating these regulations, uslegalforms offers resources to streamline the process and ensure proper submissions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.