Get Tc721

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc721 online

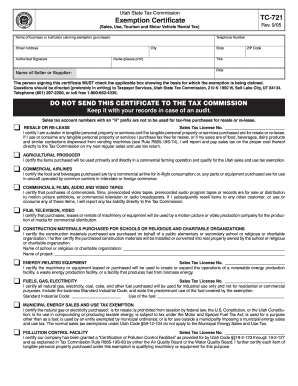

The Tc721 Exemption Certificate is an essential document for businesses and institutions claiming tax exemptions in Utah. This guide provides a step-by-step approach to filling out the Tc721 form online, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the Tc721 form online.

- Click the ‘Get Form’ button to obtain the Tc721 form and access it in your browser.

- Enter the name of your business or institution in the designated field at the top of the form. Ensure the name is spelled correctly to avoid processing delays.

- Provide your telephone number for contact purposes in the next field.

- Fill in the street address of your business or institution, followed by the city, state, and ZIP code.

- In the authorized signature section, sign and print your name legibly. Include your title and the date of signing.

- List the name of the seller or supplier from whom you are claiming the exemption in the respective field.

- Check the applicable box that corresponds to the basis for your exemption claim. This is critical for ensuring the validity of your certificate.

- If applicable, provide your sales tax account number in the designated fields where required.

- Review all the entered information for accuracy and completeness to prevent any issues during processing.

- Once completed, you can save changes to the form, download it, print it, or share it as needed.

Complete your Tc721 Exemption Certificate online today and ensure your business benefits from the applicable tax exemptions.

exempt certificate serves as documentation that allows eligible entities to make purchases without paying sales tax. This certificate is crucial for nonprofits, government agencies, and other qualifying organizations to reduce their tax burden. By presenting a taxexempt certificate at the point of sale, buyers can ensure compliance with state regulations while benefiting from significant savings. The Tc721 form plays a vital role in obtaining and utilizing this certificate effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.