Loading

Get Hmda Code Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hmda Code Sheet online

Filling out the Hmda Code Sheet online can seem daunting, but with clear guidance, you can complete it accurately and efficiently. This guide provides step-by-step instructions tailored to your needs, ensuring you understand each component of the form.

Follow the steps to complete the Hmda Code Sheet online.

- Click ‘Get Form’ button to access the Hmda Code Sheet and open it in your preferred editor.

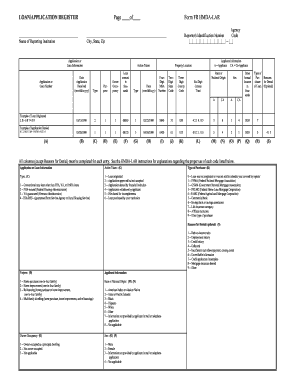

- Begin by entering the reporter's identification number, followed by the name of the reporting institution, and its city, state, and zip code. Ensure all fields are correctly filled for accurate reporting.

- Next, locate the application or loan information section. Fill in the application or loan number and the date the application was received in the format mm/dd/yyyy.

- Proceed to specify the type of loan: list whether it is a conventional loan, FHA-insured, VA-guaranteed, or FSA/RHS. Also, indicate the purpose of the loan and owner occupancy status.

- For the action taken, select from the options provided: loan originated, application approved but not accepted, denied, withdrawn, closed for incompleteness, or purchased by your institution.

- In the property location section, provide details such as the four-digit MSA number, two-digit state code, three-digit county code, and six-digit census tract.

- Next, fill out the applicant information. This should include race or national origin, sex, and gross annual income in thousands.

- If the application was denied, you have the option to specify the reasons for denial. Choose from the provided options related to debt-to-income ratio, employment or credit history, and more.

- Once all sections are complete, review your entries for accuracy. You can then choose to save your changes, download a copy, print the form, or share it as needed.

Complete your Hmda Code Sheet online today for accurate reporting.

Related links form

HMDA requires lenders to report the ethnicity, race, gender, and gross income of mortgage applicants and borrowers. Lenders must also report information regarding the pricing of the loan and whether the loan is subject to the Home Ownership and Equity Protection Act, 15 U.S.C. 1639.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.