Get Client Application Form - Pure Bridging

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Client Application Form - Pure Bridging online

Filling out the Client Application Form for Pure Bridging is a straightforward process that can be completed online. This guide provides clear instructions to ensure that all necessary details are accurately entered, facilitating a smooth application process.

Follow the steps to complete your application smoothly.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

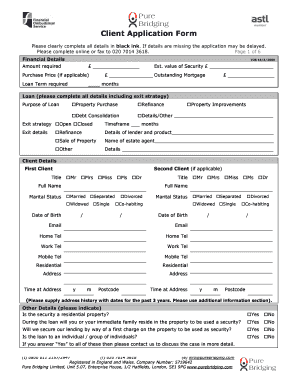

- Begin by providing the financial details in the specified sections. Enter the amount required, purchase price (if applicable), loan term, estimated value of security, and outstanding mortgage details. Select the purpose of the loan and specify your exit strategy.

- In the client details section, fill out personal information for each client, including titles, full names, marital status, and contact information such as email addresses and telephone numbers.

- Provide residential addresses for each client, along with the time spent at the current address. If applicable, include additional address history for the past three years.

- Address any other relevant details regarding the security property, such as whether it is residential, if it will be occupied during the loan, and whether a first charge will be secured.

- Complete the income details section for both clients by indicating employment status, occupation, name of employer, and annual gross income or net profit. Include any details specific to self-employed individuals.

- Fill in the client solicitor details, ensuring to provide the firm name, contact information, and request that they be prepared for an inquiry from Pure Bridging.

- In the credit history section, answer all questions truthfully regarding past mortgage refusals, bankruptcy, and any other financial matters. Provide additional information for any 'Yes' answers as directed.

- Input bank account details, including the name and address of the bank, account name, sort code, and account number for each client.

- Provide property (security) details, including address, ownership status, and lender information if the property is mortgaged. Include any valuation details if applicable.

- Carefully review all information for accuracy. Once verified, save your changes, then choose to download, print, or share the completed form as needed.

Complete your application online today to ensure timely processing.

Related links form

To qualify for bridging, you need to meet specific financial criteria, such as having a reliable income and a good credit history. You should also have a clear purpose for the funds, which is typically to cover a gap in financing when purchasing new property. The Client Application Form - Pure Bridging is designed to gather all the necessary information to help you through this process efficiently. By completing this form, you can expedite your application and increase your chances of approval.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.