Loading

Get Mortgage Loan Application Form - Dbs Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Loan Application Form - DBS Bank online

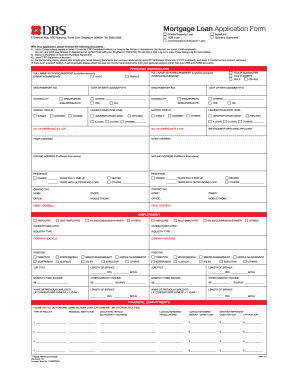

Filling out the Mortgage Loan Application Form online with DBS Bank is essential for obtaining financing for your property. This guide provides a step-by-step approach to ensure you accurately complete each section of the form, making the process more manageable.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your personal particulars. Fill in your full name as it appears on your NRIC or passport, ensuring the surname is underlined. Select your gender and provide your NRIC or passport number.

- Indicate your nationality and marital status. Include any relevant details such as whether you are a guarantor or surety. Provide your date of birth and highest education level.

- Input your home address and mailing address, if it differs. Clearly state your contact numbers, including home, office, and mobile phone, alongside your email address.

- Detail your employment information. Select your employment status (employee, self-employed, etc.) and provide the name and address of your current employer, along with your position and length of service.

- List your monthly fixed income and any other sources of monthly income. If you have had previous employment for less than a year, include details for your previous employer.

- Outline your financial commitments by listing all outstanding loans. Include the type of facility, financial institution, loan outstanding amount, and monthly repayment details.

- Provide information about the property you wish to finance. Specify the type of property, its address, purchase price, and other relevant details.

- Fill out the financial request section with details such as the loan amount and loan period for the housing loan, term loan, and other types of loans.

- Include your CPF details and specify whether you intend to use your CPF for this application. Attach any relevant CPF statements as required.

- Complete the declaration by reading the terms and conditions carefully. Ensure your information is accurate and acknowledge your consent through the signatures.

- Once you have completed the form, save any changes you made, and choose to download, print, or share the form as needed.

Start completing your Mortgage Loan Application Form online today!

Understand your Home Loan Transaction History Log in to digibank Online. Under My Accounts, select your Mortgage Loan Account. Your total outstanding mortgage loan balance. Details of your Mortgage Loan. Property Address. ... Repayment. ... Disbursement: Amount disbursed by the bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.