Loading

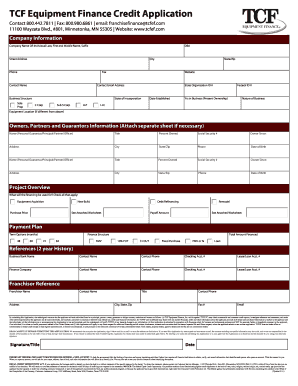

Get Tcf Equipment Finance Credit Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tcf Equipment Finance Credit Application Form online

Filling out the Tcf Equipment Finance Credit Application Form online can be a streamlined and efficient process. This guide will provide you with clear instructions and tips to ensure that you complete the application correctly and effectively.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the application form and open it in your preferred digital editing tool.

- Begin by filling out the company information section. Include the company name or your individual name, if applicable, along with any 'Doing Business As' (DBA) names, street address, city, phone number, state and zip code, and fax number. Also, include the contact person's name, their email address, and the company website.

- In the business structure section, indicate your business type (e.g., sole proprietorship, corporation), provide the state organization ID number, and the state of incorporation. Fill in additional details such as the date established, federal ID number, and years in business under current ownership. Don’t forget to describe the nature of your business as well.

- Next, provide the owners, partners, and guarantors' information. You may need to attach a separate sheet if there are multiple individuals. For each individual, include their name, title, percent owned, social security number, address, and date of birth.

- Outline the project overview by indicating what the financing will be used for by checking all applicable items such as equipment acquisition, new build, or debt refinancing. Include the relevant amounts for purchase price or payoff amounts.

- Specify your desired payment plan by selecting the term options in months, which could be 48, 60, 72, or 84 months. Choose the appropriate finance structure and total amount financed.

- List your business bank and finance company references, including the bank’s name, contact person, phone number, and account details for both checking and lease/loan accounts.

- Include the franchisor reference section with details such as the franchisor name, address, contact phone, and email address.

- Review the warranty and consent statements carefully. Ensure you understand the authorizations being granted before confirming agreement by signing. Enter your name as the authorized agent and provide the date.

- Lastly, save your progress by downloading or printing the completed form. Review all entries for accuracy before submission.

Complete your Tcf Equipment Finance Credit Application Form online today for a smooth financing process.

For equipment financing, a credit score of around 600 is generally acceptable, but higher scores can lead to better terms. The Tcf Equipment Finance Credit Application Form allows you to showcase your financial strength, which can enhance your approval chances. Remember, each lender may have different requirements, so it’s wise to check with them directly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.