Loading

Get Hertz W2 Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hertz W2 Online

Filling out the Hertz W2 Online is an important step for employees to ensure accurate reporting of income and taxes. This guide will provide you with clear and detailed instructions on how to complete each section of the form effectively.

Follow the steps to fill out the Hertz W2 Online accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

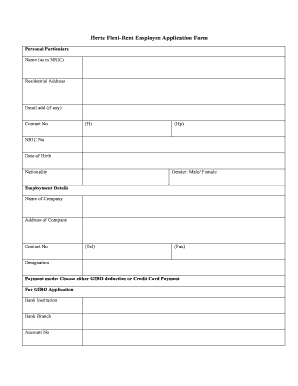

- Begin by entering your personal particulars. Fill in your name exactly as it appears on your NRIC, followed by your residential address. Provide a contact number, including your home and mobile numbers, and include your NRIC number, date of birth, nationality, and gender.

- In the employment details section, input the name of your company and its corresponding address. Include a contact number for the company, which can be a telephone or fax number, and specify your designation.

- Choose your payment mode. Select between GIRO deduction or credit card payment. If you choose GIRO, provide your bank institution, bank branch, and account number. For credit card payment, enter your card number, card validity, and type of card.

- Fill in your driving particulars, starting with your driving license number and the country of issue. Indicate whether you have ever been involved in a road accident and specify the details if applicable. Also, check yes or no for traffic demerit points and provide details if needed.

- Review the declaration statement. By signing, you are confirming that the provided information is true and correct. Authorize the necessary verification from Sime Darby Services Pte Ltd.

- Finally, sign and date the application form to complete your submission. After ensuring all information is accurate, you can save changes, download, print, or share the form as needed.

Complete your Hertz W2 Online form today to ensure your information is processed efficiently.

Related links form

If you no longer work at Hertz, you can still access your W-2 through the Hertz W2 Online platform. Simply visit the site and follow the prompts for former employees. If you need further help or cannot access your account, US Legal Forms offers resources to assist you in retrieving your W-2 efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.