Get Transfer Of Funds To A Lira Form - Local Authorities Pension Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer Of Funds To A LIRA Form - Local Authorities Pension Plan online

This guide aims to provide users with clear, step-by-step instructions on completing the Transfer Of Funds To A LIRA Form for the Local Authorities Pension Plan. Whether you are new to online document management or seeking assistance with this specific form, this guide will help facilitate a smooth submission process.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

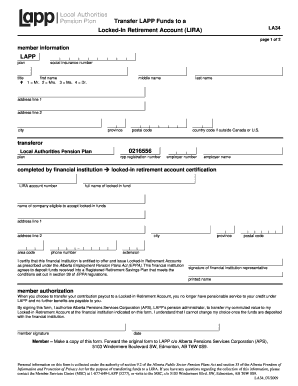

- Fill in your member information in the designated fields. This includes your title, first name, middle name, last name, social insurance number, and address. Make sure to provide complete information.

- Complete the transferor section, indicating the Local Authorities Pension Plan and relevant registration number. Be sure to include additional details like employer number and name.

- In the financial institution section, enter the locked-in retirement account number and the full name of the locked-in fund. Specify the name and address of the financial institution that is eligible to accept locked-in funds.

- The financial institution representative must certify the account. This includes signing and entering their printed name where indicated.

- Review the member authorization section carefully. By signing this section, you acknowledge your understanding of the terms related to your pension benefits.

- After completing the form, ensure all fields are correctly filled. Save your changes in the online editor before proceeding.

- You may then download or print the completed form for your records. Ensure that the original form is forwarded to the Local Authorities Pension Plan as outlined.

Complete your Transfer Of Funds To A LIRA Form online for a seamless experience.

Related links form

To transfer your pension to a LIRA, start by obtaining the Transfer Of Funds To A LIRA Form - Local Authorities Pension Plan from your financial institution or pension plan provider. Complete this form with accurate information about your pension account and the LIRA you wish to fund. Ensure that you follow any additional instructions related to the transfer process. Platforms like USLegalForms can assist in providing the necessary paperwork and guidance to make your transfer seamless.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.