Get Gst Hst New Housing Rebate Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst Hst New Housing Rebate Worksheet online

The Gst Hst New Housing Rebate Worksheet is essential for individuals claiming rebates for new housing purchases. This guide provides clear instructions for completing the worksheet online, ensuring that users can accurately submit their application for a rebate.

Follow the steps to complete the Gst Hst New Housing Rebate Worksheet online:

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

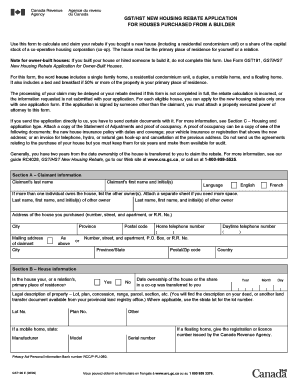

- Fill in Section A with claimant information. Provide your last name, first name, and initial(s), choose your preferred language, and include the address of the purchased house.

- In Section B, indicate whether the house is your or a relative's primary place of residence by selecting 'Yes' or 'No'. Enter the date ownership of the house was transferred and the legal description of the property.

- Select the type of housing and application type in Section C. Ensure that you check the appropriate box that reflects your situation, such as 'House (including condominium unit)' or 'Mobile home'.

- In Section D, fill out the builder information if applicable, including the builder's legal name and Business Number. Indicate whether the builder paid the rebate directly to you or credited it against the total amount.

- Complete Section E to certify your information is accurate. Sign and date this section to affirm that you meet the eligibility criteria for the rebate.

- If applicable, fill out Section F specifically for the Nova Scotia rebate. Answer all questions related to your previous residences in Canada.

- Proceed to Section G for rebate calculation. Depending on your application type, complete the appropriate part (I, II, or III) to calculate the rebate amount based on the information provided.

- Once all sections are filled out, review your information for accuracy and completeness to avoid delays or denial of your claim.

- Finally, you may save changes, download, print, or share the completed form as needed.

Complete your Gst Hst New Housing Rebate Worksheet online to ensure a smooth application process.

To apply for the GST rebate for new homes, complete the Gst Hst New Housing Rebate Worksheet thoroughly. This worksheet includes all required information for your application. After filling it out, submit it along with any necessary documentation to the Canada Revenue Agency. You can find resources and support on platforms like uslegalforms to help guide you through the application process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.