Get New Brunswick Tuition Rebate Form For Taxation Year 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Brunswick Tuition Rebate Form for Taxation Year 2011 online

Filling out the New Brunswick Tuition Rebate Form for Taxation Year 2011 can be a straightforward process when approached step by step. This guide provides clear instructions to help users navigate the online completion of the form, ensuring all necessary information is accurately recorded.

Follow the steps to complete your application online.

- Click the ‘Get Form’ button to access the application form and open it for editing.

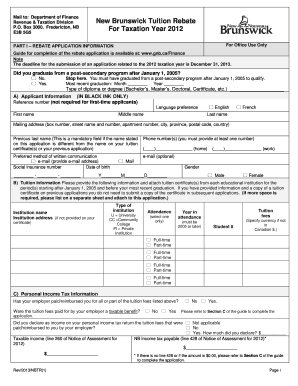

- Begin with 'Part I – Rebate Application Information'. Answer the question about whether you graduated from a post-secondary program after January 1, 2005 by selecting 'Yes' or 'No'. If 'Yes', fill in your most recent graduation month and year.

- Complete 'A) Applicant Information'. Fill in your first name, middle name, last name, mailing address, and contact information including phone numbers. Choose your language preference and indicate your social insurance number and date of birth.

- Move to 'B) Tuition Information'. Provide details about the educational institutions you attended. Include the institution name, address, type (University, Community College, or Private Institution), tuition fees, years of attendance, and your student number. You must attach tuition certificates for your submitted tuition fees.

- In 'C) Personal Income Tax Information', indicate if your employer reimbursed you for tuition fees. If they did, clarify whether those benefits were declared on your personal income tax return. Provide your taxable income as taken from your Notice of Assessment.

- Complete 'E) Declaration and Consent' by signing and dating the form. Ensure you understand the implications of providing accurate information and consenting to the disclosure of personal data.

- Review all provided information for accuracy. Ensure attachments such as tuition certificates and proof of graduation are included as specified in the application guidelines.

- Finally, you can save your changes to the form, download it, print it for your records, or share it as necessary.

Complete your New Brunswick Tuition Rebate Form online to ensure you receive the rebate benefits you are entitled to.

Yes, you can receive a tax refund for tuition through the tuition tax credit. When you file your taxes, the credit reduces your taxable income, which may lead to a refund if you have overpaid. To take advantage of this, complete the New Brunswick Tuition Rebate Form For Taxation Year 2011 and include it with your tax return. This process can be straightforward with guidance from platforms like uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.