Loading

Get Application For Rebate Of Property Taxes - Town Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION for REBATE of PROPERTY TAXES - Town Of ... online

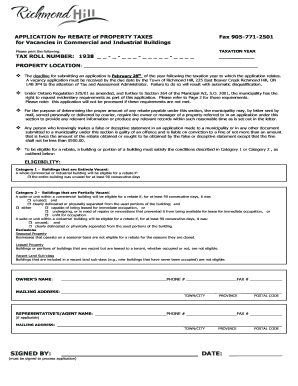

This guide provides step-by-step instructions on how to effectively complete the APPLICATION for REBATE of PROPERTY TAXES for vacancies in commercial and industrial buildings online. Follow the outlined steps to ensure your application is properly submitted and that you meet all necessary requirements.

Follow the steps to fill out the application effectively.

- Click 'Get Form' button to access the application and open it in the desired editor.

- Fill in the taxation year and tax roll number at the top of the form. The tax roll number can be found on your Notice of Property Assessment or property tax bill.

- Provide the complete property location, including the full mailing address along with town/city and province.

- Enter the owner's name, their phone number, and fax number, if applicable. This is important for communication regarding your application.

- List the representative’s or agent’s name and their contact information, including phone number and fax number if available. Their details are necessary if the owner will not be submitting the form themselves.

- Indicate the date of submission. This will be crucial for processing your application by the deadline of February 28th.

- Provide details regarding the vacancy: specify the size of the vacant area, the name of the last tenant, and the period of vacancy using the provided date format.

- Ensure to include the evidentiary requirements as detailed in the form, such as copies of executed leases and any relevant documentation regarding the vacancy.

- Make sure to review all entries for accuracy and completeness; ensure that the application is signed by the appropriate person to avoid disqualification.

- Once all fields are correctly filled out, save your changes, and choose to download, print, or share the completed application form as needed.

Complete your documents online to ensure a brief and efficient application process.

Related links form

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund. If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.