Loading

Get Cra Fillable T2054

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cra Fillable T2054 online

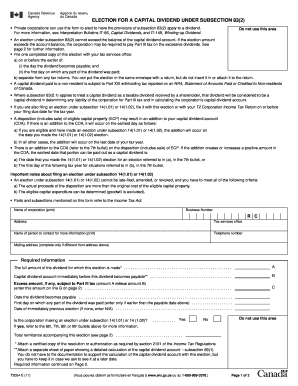

The Cra Fillable T2054 form is used by private corporations to elect to apply specific provisions regarding capital dividends. This guide provides clear, step-by-step instructions to help users effectively complete the form online.

Follow the steps to successfully complete the Cra Fillable T2054 form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing application.

- Enter the name of the corporation in the designated field. Ensure the name is printed clearly.

- Provide the business number, using the proper format, in the field labeled 'Business Number.'

- Fill in the address of the corporation, ensuring all fields are completed accurately.

- In the 'Name of person to contact for more information' section, enter the full name of the contact person.

- Input the telephone number of the contact person in the corresponding field.

- If the mailing address is different from the address above, complete this section with the required information.

- Indicate the full amount of the dividend for which this election is made in the appropriate field labeled ‘Full amount of the dividend for which this election is made.’

- Enter the capital dividend account balance immediately before the dividend becomes payable in the indicated field.

- If applicable, calculate and enter any excess amount subject to Part III tax, as specified in the form.

- Record the date the dividend becomes payable in the designated field.

- Complete the section about any part of the dividend that was paid before the payable date, if applicable.

- Include the date of any immediately previous election, if applicable, or enter 'N/A' if none exists.

- Answer whether the corporation is making an election under subsections 14(1.01) or 14(1.02) by selecting 'Yes' or 'No.'

- If any total remittance accompanies this election, indicate that amount in the corresponding field.

- Attach any required documentation, such as a certified copy of the resolution or authorization.

- Review all entered information for accuracy before saving the form.

- Once completed, save your changes, and then proceed to download, print, or share the form as required.

Complete your Cra Fillable T2054 form online today to ensure compliance and accuracy.

To pay a capital dividend, a corporation must file a special election (Form T2054) with the Canada Revenue Agency under section 83 of the Income Tax Act on or before the earlier of the date the dividend becomes payable and the first day on which any part of the dividend is paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.