Loading

Get Canada T1135 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1135 Form online

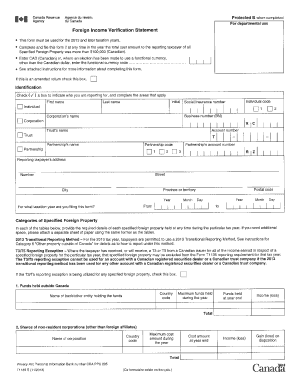

Filling out the Canada T1135 Form is an important process for individuals and entities reporting foreign income and assets. This guide provides clear and detailed instructions to assist you in completing the form online effectively.

Follow the steps to fill out the Canada T1135 Form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This includes your name, address, and contact details. Ensure all entries are accurate to avoid processing delays.

- In the section for foreign income, report any foreign investments by providing details such as the type of income, currency used, and the amount earned. If applicable, refer to your financial records for precision.

- Next, list all foreign property held during the year. This section requires detailed information about each asset, including the country where the property is located and its fair market value.

- If applicable, indicate if you have made any changes to your foreign assets during the year. This includes acquisitions or disposals that occurred.

- Review the information you have entered for accuracy. It is crucial that all data is correct before submission.

- Once you are satisfied with the completed form, save your changes, and choose your preferred option to download, print, or share the form. Ensure that you retain a copy for your records.

Complete your Canada T1135 Form online today to ensure compliance and accurate reporting.

To complete the Canada T1135 Form, you need specific documents detailing your foreign assets. Gather statements, account records, and any relevant information that reflects your ownership and value of these assets. Having all necessary documents ready will streamline your filing process and help ensure compliance with Canadian tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.