Get Annual Information Return - Alberta Finance And Enterprise ... - Finance Alberta

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annual Information Return - Alberta Finance And Enterprise online

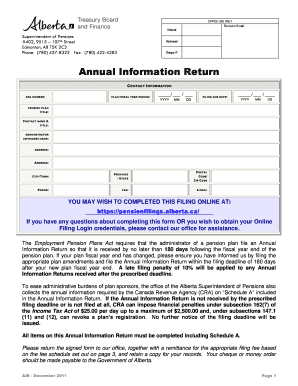

Completing the Annual Information Return is a crucial task for pension plan administrators to ensure compliance with Alberta regulations. This guide provides clear instructions for filling out the form online, making the process streamlined and efficient for all users.

Follow the steps to complete your Annual Information Return online:

- Press the ‘Get Form’ button to access the Annual Information Return, ensuring you have the latest version for your online completion.

- Fill in the contact information section, including the CRA number, plan fiscal year ending date, and filing due date.

- Provide detailed information about the pension plan, including the title, contact name and title, and administrator name and address.

- In the section titled 'Change in Assets,' report the market value of assets, contributions, expenses, and benefits paid during the fiscal year.

- Complete the 'Amount of Assets' section, indicating how much the sponsor/administrator manages the investment decision.

- For specified multi-employer pension plans, complete the 'Total Number of Hours of Covered Employment' as necessary.

- Fill out the 'Current Portfolio Mix' section detailing the percentage of assets in various categories, ensuring the total adds up to 100%.

- Provide the net fund rate of return for the plan year.

- Fill in the 'Membership Reconciliation' section with all relevant membership changes throughout the plan year.

- Accurately record area of employment data, listing the number of active members and fee information.

- Fill out CRA Schedule A, addressing all required questions accurately.

- Review the certification section carefully, ensuring all statements are true and complete, and sign before submission.

- Once all fields are filled accurately, users can save changes, download, print, or share the completed form as necessary.

Complete your Annual Information Return online to ensure compliance and simplify your reporting process.

Yes, in Alberta, corporations are required to renew their registration annually. This renewal is part of your obligation to submit the Annual Information Return - Alberta Finance And Enterprise ... - Finance Alberta. Failing to renew can lead to penalties or the dissolution of your corporation. To simplify this process and ensure compliance, consider using US Legal Forms, which provides templates and guidance for your annual filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.