Get Hapset

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hapset online

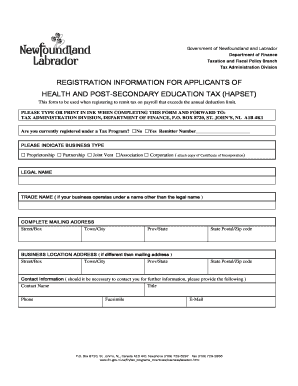

The Hapset form is an essential document used for registering to remit tax on payroll that exceeds the annual deduction limit. This guide will provide you with clear, step-by-step instructions on how to fill out the form accurately and efficiently.

Follow the steps to complete the Hapset form accurately.

- Press the ‘Get Form’ button to access the Hapset form and open it for editing.

- Indicate your current registration status under a Tax Program by selecting either 'Yes' or 'No' and entering your Remitter Number if applicable.

- Specify your business type by selecting the appropriate checkbox for Proprietorship, Partnership, Joint Venture, Association, or Corporation. If you are a corporation, attach a copy of your Certificate of Incorporation.

- Provide the legal name of your business and the trade name if it operates under a different name. Fill in your complete mailing address, including street, town/city, province/state, and postal/zip code.

- If your business location is different from the mailing address, enter the relevant business location address in the specified fields.

- Enter your contact information for follow-up inquiries, including the contact name, title, phone number, facsimile number, and email address.

- Fill out the banking information, including the bank name, address, bank number, transit number, postal/zip code, and account number.

- Provide information about the owners and directors of the business, including their names, dates of birth, titles, and home addresses. If there are more than two, please provide the additional information on a separate sheet.

- If your business has multiple locations, complete the section for multiple locations, providing similar contact information as required.

- Include details related to the fiscal year end, federal business number, commencement dates, and the nature of your business.

- Certify the accuracy of the information provided by printing your name, signing, including your title, and entering the date.

- Once you have completed the form, you can save changes, download, print, or share the document for submission.

Get started now and fill out your Hapset form online for efficient tax registration.

Several provinces in Canada, including Quebec and Ontario, implement health and post-secondary education taxes. These taxes are crucial for funding essential services that support both healthcare and education systems. Understanding the implications of these taxes can help individuals and businesses plan effectively. If you need guidance on navigating these taxes, uslegalforms offers resources to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.