Get 8833 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8833 Form online

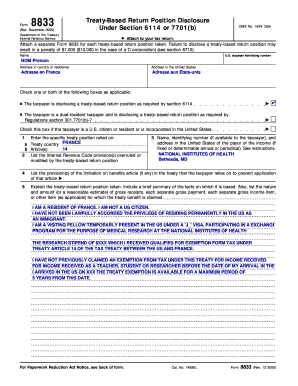

Filling out the 8833 Form is essential for disclosing treaty-based return positions as per the requirements of the Internal Revenue Service. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the 8833 Form online.

- Click ‘Get Form’ button to obtain the form and access it in the editor for online completion.

- Fill in your name and U.S. taxpayer identifying number. Be sure to enter accurate information to avoid complications.

- Enter your address in the country of residence, followed by your address in the United States, ensuring to follow the correct format for each.

- Check any applicable boxes that relate to the treaty-based return position you are disclosing, such as whether the taxpayer is a dual-resident taxpayer.

- Specify the treaty country you are relying on, along with the relevant article numbers from the treaty.

- List any Internal Revenue Code provisions that the treaty-based position may override or modify.

- Provide the name, identifying number (if available), and address of the income payor in the United States, if applicable.

- Enter details about the limitation on benefits article in the treaty if it is being relied upon.

- Explain the treaty-based return position you are taking. Include a brief summary of your circumstances and the nature and amount of any income for which the treaty benefit is claimed.

- Once all fields are completed, review your entries for accuracy, then save changes, and choose to download or print the form as necessary for submission with your tax return.

Complete your documents online today for a smooth filing process.

To properly fill out a tax withholding form, start by gathering your personal information, including your Social Security number and filing status. Then, accurately estimate your income, deductions, and credits to determine the correct withholding amount. Finally, double-check your entries for accuracy and use resources like US Legal Forms for templates and guidance to help ensure you meet the requirements and avoid future complications.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.