Get 151 Vat Directive Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 151 Vat Directive Form online

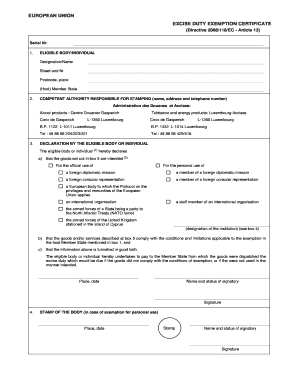

Filling out the 151 Vat Directive Form is essential for qualifying individuals or bodies seeking exemption from excise duty. This guide provides a structured approach to assist you in completing the form accurately and efficiently online.

Follow the steps to fill out the 151 Vat Directive Form online

- Click ‘Get Form’ button to download the 151 Vat Directive Form and open it for editing.

- In section 1, enter the designation or name, street and number, postcode, and place of the eligible body or individual, as well as the host Member State.

- In section 2, provide the name, address, and telephone number of the competent authority responsible for stamping the form. This typically includes the relevant departments and contact details.

- In section 3, declare the intention of the goods listed in box 5. Indicate whether the goods are for official or personal use or other specified classifications.

- In section 5A, enter the information concerning the authorized warehouse-keeper including their name, address, Member State, and excise number.

- In section 5B, provide a detailed description of the goods for which the exemption is requested, including the quantity, value excluding excise duty, and total amount.

- In section 6, obtain certification from the competent authorities of the host Member State, ensuring the consignment meets the conditions for exemption.

- In section 7, if applicable, indicate permission to dispense with the stamp from box 6, providing the relevant details of the competent authority.

- Finally, review the completed sections for accuracy, then save changes, download, print, or share the form as necessary.

Complete the 151 Vat Directive Form online today to ensure your exemption from excise duty is processed smoothly.

To qualify for a VAT refund in Europe, businesses generally need to meet a minimum spending threshold, which varies by country. Often, the amount spent must exceed a specified limit to file for a refund through the 151 Vat Directive Form. Additionally, keeping accurate records of your purchases is crucial for a successful claim. Utilizing the 151 Vat Directive Form can simplify this process and maximize your potential refund.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.