Loading

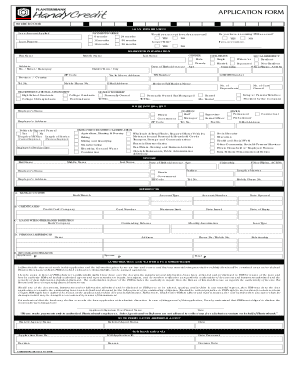

Get Credit 2092 (revised 06.2009). Handy Credit Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CREDIT 2092 (Revised 06.2009). Handy Credit Application Form online

Filling out the CREDIT 2092 (Revised 06.2009) Handy Credit Application Form online can be a straightforward process with proper guidance. This guide will help you navigate through each section of the form, ensuring you provide all necessary information correctly.

Follow the steps to fill out the form online:

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin with the loan information section. Specify the amount you wish to borrow and select your desired payment scheme from the options provided (e.g., 6 months, 12 months, etc.).

- In the borrower information section, fill out your personal details, including your first name, middle name, last name, gender, civil status, address, date of birth, and contact information.

- Indicate your highest educational attainment and provide your TIN number, age, and years at your current address. Make sure to include your email address for communication purposes.

- Complete the home ownership section by indicating your living situation (e.g., personally owned, rented) and providing additional details such as the number of cars owned and dependents.

- The work information section requires details about your employer, including their name, address, your position, and length of service.

- If applicable, provide information about your spouse and any financial references, including bank accounts, credit cards, and other loans with different institutions.

- In the authorization and waiver of confidentiality section, carefully read the terms and affirm your understanding before signing the application.

- Review all the information you've filled out for accuracy and completeness before finalizing your application.

- Once finished, you can save your changes, download, print, or share the completed form as needed.

Start filling out your forms online today!

When asking for a credit application, approach the lender directly and express your interest in obtaining credit. You can do this in person or through their website. Request the CREDIT 2092 (Revised 06.2009). Handy Credit Application Form, as it is often available for download or in physical form at their branch, making the application process easier for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.