Loading

Get Ir264

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir264 online

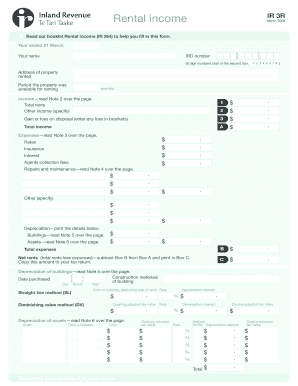

The Ir264 form is essential for reporting rental income from properties. This guide will help users navigate through each section of the form, ensuring accurate completion and compliance with tax regulations.

Follow the steps to successfully complete the Ir264 form.

- Press the ‘Get Form’ button to access the Ir264 form and open it in the document editor.

- Enter the year ended 31 March in the designated field. This refers to the fiscal year for which you are reporting your rental income.

- Provide your name and IRD number, ensuring your IRD number is an eight-digit number, with the second box used for other formats.

- Input the address of the property you are renting out.

- Indicate the period the property was available for renting in months.

- Report your total rents received in Box 1. Document any additional income related to the rental property in Box 2, specifying the sources.

- If applicable, declare any gain or loss on the disposal of assets in Box 3. Note that losses should be entered in brackets.

- Calculate your total income by adding Boxes 1, 2, and 3. If Box 3 represents a loss, subtract it from the total of Boxes 1 and 2 and enter this in Box A.

- Proceed to expenses. Document all relevant expenses in their corresponding fields, including rates, insurance, and other costs.

- Calculate depreciation on buildings and assets, following the instructions laid out for each method (straight line or diminishing value).

- Submit your final totals for expenses. Calculate net rents by subtracting Box B from Box A and print the result in Box C.

- After reviewing your entries for correctness, you can save your changes, download a copy, print the form, or share it as required.

Complete your tax documents online today to ensure accurate and timely submission.

Filing an Income Tax Return (ITR) for only rental income requires you to report your earnings and claim applicable deductions. Use the appropriate forms, like the Ir264, to detail your rental income and expenses clearly. If you need further help, UsLegalForms provides resources that can guide you through the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.