Get A3c Web 2010. Capital Acquisitions Tax And Probate - Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the A3C Web 2010. Capital Acquisitions Tax And Probate - Revenue online

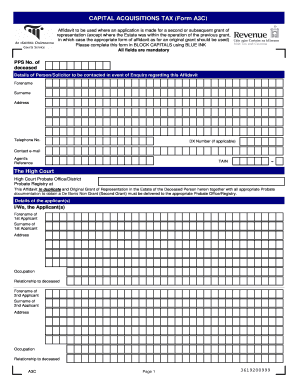

Filling out the A3C Web 2010. Capital Acquisitions Tax And Probate - Revenue form online is a vital step in managing the estate of a deceased individual. This guide will provide clear, step-by-step instructions for completing the form accurately and efficiently.

Follow the steps to complete the A3C Web 2010 form online successfully.

- Click ‘Get Form’ button to access the A3C Web 2010 form and open it in your preferred editing tool.

- Begin with Section 1 by entering the PPS number of the deceased. This is crucial for identifying the individual's tax responsibilities.

- In the designated area, provide your contact details including forename, surname, address, telephone number, DX number (if applicable), and email address.

- Fill in the section for Details of the applicants, ensuring all fields are completed with the forename, surname, address, occupation, and relationship to the deceased for each applicant.

- In the Details of Deceased Person section, input the forename, surname, address, date of death, place of death, and domicile at death of the deceased.

- Proceed to the section requesting details about unadministered assets. Specify the value of personal and real property in whole euros only, and list any debts due and unpaid.

- Indicate if a fresh grant is required and provide details if the original personal representative is deceased, including the dates of their death and previous grant of representation.

- Sign the affidavit in the designated areas, ensuring to indicate your identity verification method and have a Commissioner for Oaths or Practising Solicitor witness your signature.

- Review all entered information for accuracy before concluding. Ensure all applicants have signed where required.

- Once completed, save your changes. You can download, print, or share the form as needed for your records or submission.

Complete your Capital Acquisitions Tax and Probate forms online with confidence!

Related links form

A statement of affairs in probate is a document that outlines all the assets and liabilities of the deceased's estate. It provides a clear picture of the estate’s financial situation, which is essential for settling debts and distributing assets. This statement plays a crucial role in the probate process. To prepare a comprehensive statement, uslegalforms can offer templates and guidance to ensure everything is in order.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.