Get Deduction At Source Authorisation Form - Tui

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the deduction at source authorisation form - TUI online

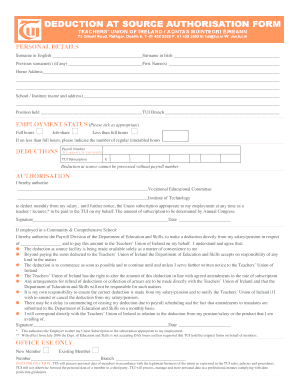

Completing the deduction at source authorisation form - TUI online is essential for facilitating your membership subscription to the Teachers’ Union of Ireland. This guide provides clear instructions to help you navigate each section of the form effortlessly.

Follow the steps to complete the deduction at source authorisation form online.

- Click ‘Get Form’ button to access the form and open it in your document editor.

- Begin by filling out your personal details. Include your surname in English and Irish, previous surnames (if any), first name(s), home address, and the name and address of your school or institute.

- Next, indicate your employment status by selecting the appropriate option: full hours, job-share, or less than full hours. If you select less than full hours, specify the number of regular timetabled hours.

- Provide your payroll number as it appears on your payslip. Remember that the deduction at source cannot be processed without this number.

- Enter the amount for your TUI subscription in euros. Ensure that this amount is correct as it will be deducted from your salary.

- In the authorisation section, you will need to authorize the deduction of your subscription by providing the names of your Vocational Educational Committee or Institute of Technology. Sign and date the form in the designated spaces.

- If applicable, provide a similar authorisation to the Payroll Division of the Department of Education and Skills. Ensure you understand all conditions outlined, sign, and date this section as well.

- Review your completed form for accuracy, ensuring all required sections are filled out correctly.

- Once you are satisfied with your entries, you can save the changes, download the form, print it, or share it as needed.

Complete your deduction at source authorisation form online today to ensure your TUI membership is active.

Yes, an employer can perform payroll deductions with your consent, provided you have signed a formal agreement. The DEDUCTION AT SOURCE AUTHORISATION FORM - TUI serves as a crucial document in this process, outlining the specifics of the consent and the reasons for the deduction. It is important to review this form carefully before signing, as it helps protect your rights and ensures transparency in how your earnings are handled. Always communicate with your employer if you have questions about any deductions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.