Loading

Get Form Ca24 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ca24 2000 online

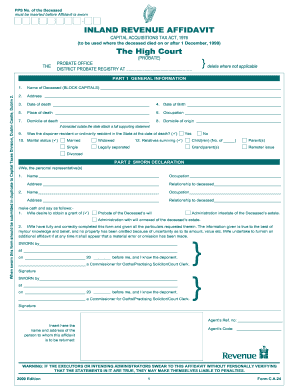

Filling out the Form Ca24 2000 online is an essential step in managing the estate of a deceased individual. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the form correctly

- Click ‘Get Form’ button to obtain the form and open it for filling out.

- Begin with Part 1, General Information. Fill in the name of the deceased in block capitals, their address, date of death, date of birth, place of death, occupation, domicile at death, and domicile of origin. Indicate if the deceased was a resident in the State at the time of death and their marital status.

- In Part 2, Sworn Declaration, enter the names, occupations, and addresses of the personal representatives as well as their relationship to the deceased. Confirm the type of grant desired: probate, administration intestate, or administration with will annexed.

- Complete Part 3, Property in the State. List all property owned by the deceased, including real estate, household contents, vehicles, and business assets, along with their gross market values. Make sure to attach relevant supporting documents as specified.

- Proceed to Part 4 for property outside the State, and detail each property’s description and gross market value at the date of death.

- In Part 5, Questionnaire, answer all questions appropriately, marking 'yes' or 'no' as applicable. Provide additional details for any affirmative responses.

- Fill in Part 6 with information on benefits under the will or succession act that exceed specified values, noting the beneficiary details and approximate value of each benefit.

- Complete Part 7, which summarizes benefits to ensure compliance with group thresholds. Confirm the completion for each beneficiary and provide the necessary details.

- Review the entire form for accuracy and completeness before saving your changes. You can choose to download, print, or share the form as needed.

Start completing your Form Ca24 2000 online today to ensure efficient estate management.

The value of the estate Normally, an asset worth less than €25,000 will not be subject to Probate. However, you will need to check directly with the bank or financial institution holding your loved one's asset.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.