Loading

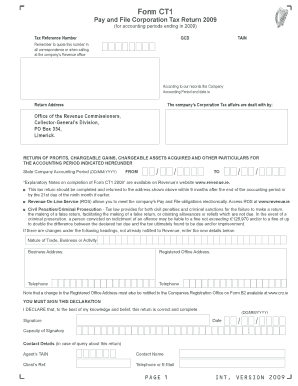

Get Ct1 Form Ireland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct1 Form Ireland online

This guide provides comprehensive instructions for completing the Ct1 Form in Ireland online. It aims to assist both experienced and inexperienced users in understanding the various components of the form and the steps involved in submission.

Follow the steps to complete the Ct1 Form accurately.

- Press the ‘Get Form’ button to access the Ct1 Form and open it in your chosen editor.

- Input your Tax Reference Number in the designated field on the form. This number is essential for all correspondence related to your corporation tax affairs.

- Specify the Company Accounting Period by entering the start and end dates in the required format (DD/MM/YYYY).

- Provide the company’s Return Address as instructed, ensuring it matches the address associated with the corporation tax.

- Fill in the details under the RETURN OF PROFITS section, which pertains to chargeable gains and other particulars for the accounting period.

- Complete the COMPANY DETAILS section by entering information on whether the company is trading through a branch or agency and stating any other relevant details.

- If applicable, provide details regarding any close company shareholders and their beneficial ownership.

- Review and complete any additional sections related to income, including trading results, rental income, and foreign income as necessary.

- Ensure to sign the declaration section, confirming that the information provided is complete and accurate. Enter the date of signature.

- Finalize the process by saving your changes, downloading the form for your records, or opting to share it as needed.

Complete your Ct1 Form and manage your corporation tax obligations online today!

To obtain an Irish tax clearance certificate, you need to apply through the Revenue Commissioners, providing relevant information about your tax compliance. This certificate is crucial for businesses looking to engage in contracts or secure funding, as it demonstrates that your tax affairs are in order. For clarity on the application process, consider checking out the Ct1 Form Ireland available on uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.