Loading

Get Form Cg1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Cg1 online

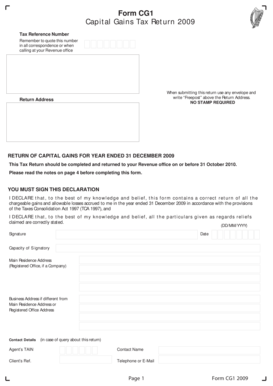

Filling out the Form Cg1, also known as the Capital Gains Tax Return, can seem daunting. However, this guide provides a step-by-step approach to help you complete the form accurately and confidently in an online environment.

Follow the steps to successfully complete the Form Cg1 online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

- Enter your Tax Reference Number at the top of the form, ensuring it is quoted in all correspondence.

- Complete the 'Return of Capital Gains for Year Ended 31 December 2009' section by filling in your personal information.

- In the section detailing assets disposed of, list each asset category by ticking the relevant boxes and providing numeric details for each disposal.

- Indicate if any disposals were made between connected persons or otherwise not at arm's length by providing the necessary details in the following fields.

- Proceed to fill in the claim to reliefs section, ensuring to specify amounts for transactions listed for both yourself and your spouse, if applicable.

- Complete the chargeable gains section, detailing any previous gains rolled over, net losses for the year, and personal exemptions.

- Continue to fill out the net chargeable gain entries for the various periods and source types specified.

- Once all sections are filled, review your entries for accuracy before finalizing.

- Save your changes, and when ready, download, print, or share the completed form as necessary.

Start filling out your documents online today to ensure accuracy and compliance.

A CG1 form specifically refers to a document used to report capital gains or losses to the tax authorities. This form is crucial for anyone who has sold an asset and needs to report the resulting financial changes. Understanding the purpose and proper usage of the CG1 form will help ensure you meet your tax obligations accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.