Get Form Cg1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Cg1 online

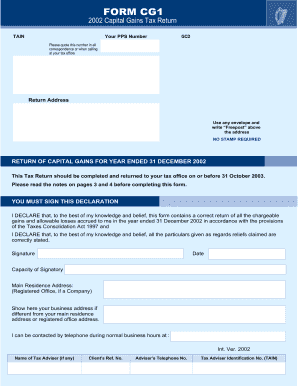

Filling out the Form Cg1 is an essential step for reporting capital gains to your tax office. This guide provides clear and detailed instructions on how to accurately complete the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete your Form Cg1 online.

- Press the ‘Get Form’ button to access the form and load it into the editor.

- Enter your PPS Number in the designated field. This identifier is crucial for tax correspondence.

- Provide your return address in the specified area, ensuring to write 'Freepost' above it to utilize the no-stamp-required service.

- Complete the section titled 'Return of Capital Gains for Year Ended 31 December 2002.' Ensure all details are accurate before proceeding.

- Sign the declaration section with your name and date to affirm the accuracy of your return.

- If applicable, list your main residence address or any different business address in the related fields.

- In the 'Details of Disposal of Assets' section, input all necessary information regarding asset disposals, including categories and amounts.

- Calculate the net gain or loss for each asset category and record it accurately in the provided fields.

- Review the claimed reliefs, ensuring all details are indicated clearly.

- After finalizing your entries, save your changes, and either download, print, or share the completed Form Cg1.

Complete your Form Cg1 online today to ensure timely and accurate reporting of your capital gains.

Get form

Form Cg1 is designed to assist individuals and businesses in reporting specific financial information clearly and accurately. This form plays a significant role in ensuring compliance with tax laws and helps reduce the risk of audits. When you use Form Cg1 through the US Legal Forms platform, you gain access to reliable templates and guidance, making the filing process simpler and more efficient. Choosing the right form is vital for a smooth tax experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.