Loading

Get P13 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P13 Form online

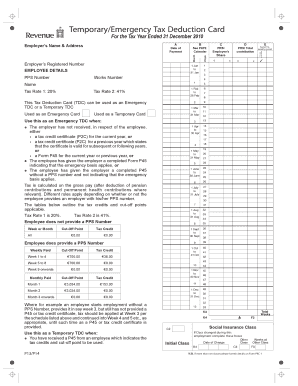

Filling out the P13 Form online is a straightforward process that ensures you provide essential information regarding your tax details efficiently. This guide will walk you through each section and field of the form, making it easy for you to complete your submission accurately.

Follow the steps to successfully complete the P13 Form online.

- Click the ‘Get Form’ button to download and open the P13 Form in your editor.

- Begin with the employer's registered number section. Enter the correct number as assigned to your organization. This information is crucial for tax records.

- Next, fill in the employee details, beginning with their name and address. Make sure to include the PPS number, as it identifies the employee for tax purposes.

- Indicate the tax period by entering the start and end dates. For example, specify from February 1 to February 28.

- Complete the tax rate sections accurately. Enter the appropriate tax rates and credits based on the tax deduction applicable, referencing the details from tables on the form.

- Fill in the gross pay information. This should include all forms of pay like overtime and bonuses but exclude deductions for pension contributions.

- Indicate the appropriate cut-off points and apply the relevant tax rates. Ensure to differentiate between the emergency TDC and temporary TDC based on the details provided.

- Review all sections for accuracy. Cross-check the employee details against their documents to ensure that all information aligns correctly.

- Once you have filled in all the required fields, save your changes. You may choose to download, print, or share the completed form as needed.

Complete your P13 Form online today to ensure timely and accurate processing of your tax information.

You may receive a tax refund based on your P60 if you have overpaid your taxes. To initiate the process, ensure you have completed the P13 Form accurately. The ZRA will assess your tax records and issue a refund accordingly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.