Loading

Get Document Customs Value

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Document Customs Value online

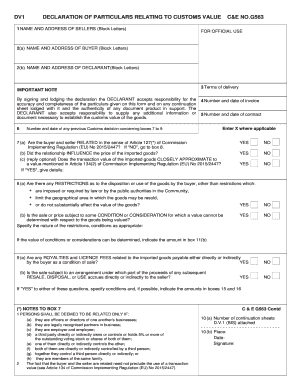

The Document Customs Value, also known as DV1, is essential for declaring the customs value of imported goods. This guide provides clear instructions for users on how to accurately fill out this form online, ensuring compliance and accuracy.

Follow the steps to accurately complete the Document Customs Value form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Box 1 with the name and address of the seller in block letters. Ensure all details are accurate and clear.

- In Box 2(a), enter the name and address of the buyer, also in block letters. In Box 2(b), provide the name and address of the declarant.

- Review the important note regarding the declaration. Acknowledge that by signing, the declarant assumes responsibility for the accuracy of the information provided.

- Fill out Box 3 with the terms of delivery. In Box 4, provide the number and date of the invoice; in Box 5, enter the number and date of the contract.

- Complete Box 7(a) by indicating if the buyer and seller are related, as per Article 127. If 'yes', proceed to Box 7(b) to address whether the relationship influenced the price. Continue to Box 7(c) to specify if the transaction value is comparable to previously established values.

- In Box 8(a), indicate if there are any restrictions on the goods by answering 'yes' or 'no'.

- In Box 9(a), state whether any royalties and license fees are related to the imported goods and complete Box 9(b) for any conditions affecting the sale or price.

- In Box 10(a), list the number of continuation sheets, if applicable. Fill in Box 10(b) with the place, date, and your signature.

- Proceed to the back of the form to complete Boxes 11 through 24 as needed, paying attention to costs and deductions to arrive at the declared customs value.

- Once all sections are filled out correctly, users can save changes, download, print, or share the form as needed.

Complete your Document Customs Value online to ensure a smooth customs process.

Rule 3 of customs valuation states that the value of goods can be determined based on the transaction value of identical or similar goods. This means customs can use values from previously imported goods that are comparable to your shipment. Understanding this rule helps you adequately Document Customs Value, ensuring accurate assessments by customs officials.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.