Loading

Get Form Ic6

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ic6 online

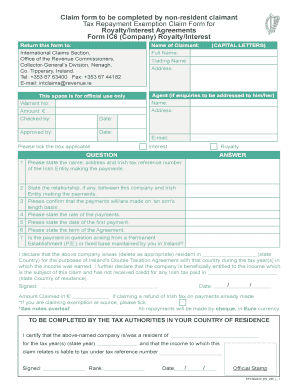

Filling out the Form Ic6 online is a crucial step for individuals or entities claiming tax repayment exemption on royalty or interest agreements. This guide provides detailed instructions on how to complete each section of the form effectively and accurately, ensuring a smooth submission process.

Follow the steps to complete the Form Ic6 online:

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the claimant's full name in the designated field.

- Provide the contact details including the address and email in the respective sections.

- Fill in the amount claimed in Euros along with any additional necessary information for official use.

- Respond to the questions regarding the Irish Entity by stating its name, address, and tax reference number.

- Indicate the relationship, if any, between your company and the Irish Entity making the payments.

- Confirm if the payments are made on an arm’s length basis.

- Specify the rate of the payments and the date of the first payment.

- Mention the term of the agreement and whether the payment arises from a Permanent Establishment maintained in Ireland.

- Complete the declaration of residency for tax purposes, ensuring to fill your country of residency.

- Sign and date the form at the designated areas.

- After completing the form, save your changes, and you can choose to download, print, or share the document.

Start filling out your Form Ic6 online today!

Filing Form 10 IC of the Income Tax Act is a straightforward process. Begin by collecting all relevant financial information and documentation. Navigate to the official tax authority's website to download the form, and ensure you complete it accurately. If you find the process overwhelming, US Legal Forms offers comprehensive resources to help you efficiently file your Form Ic6.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.