Get Trcn1 - Tax Registration Cancellation Notification - Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TRCN1 - Tax Registration Cancellation Notification - Revenue online

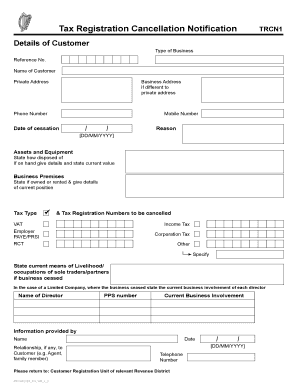

Filling out the TRCN1 form is an essential step for individuals and businesses looking to cancel their tax registration. This guide will provide you with comprehensive, step-by-step instructions to ensure a smooth and accurate submission process.

Follow the steps to successfully complete the TRCN1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the details of the customer. Input the reference number, name, private address, and business address if it differs from the private address.

- Enter the contact information including the phone number and mobile number. This ensures the relevant parties can reach you if further information is needed.

- Specify the date of cessation of the business and provide the reason for cancellation in the designated fields.

- Detail the assets and equipment. State how these have been disposed of. If any are still on hand, provide the current value.

- Indicate the status of the business premises, whether owned or rented, and give details about the current position of the premises.

- Select the tax types and enter the relevant tax registration numbers that need to be canceled, including VAT, Income Tax, Employer PAYE/PRSI, RCT, Corporation Tax, or any other specified type.

- If applicable, state the current means of livelihood or occupations for sole traders or partners if the business has ceased. For limited companies, indicate the current business involvement of each director.

- Input the name of each director along with their PPS number and current business involvement.

- Provide information about the person who filled out the form, including their name and relationship to the customer, if any.

- Finally, input the date and telephone number for facilitating any follow-up. Review all information for accuracy.

- Once all sections are completed, save changes, download, print, or share the form as necessary.

Complete your TRCN1 form online today to efficiently manage your tax registration cancellation.

The TRCN1 - Tax Registration Cancellation Notification - Revenue is a specific form used to officially notify tax authorities of the cancellation of tax registration. This form is essential for individuals and businesses wishing to cease their tax obligations. Completing the TRCN1 ensures that you are no longer liable for income tax and helps prevent future tax complications. Platforms like USLegalForms provide easy access to this form and offer guidance on its completion.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.