Get Form Vat 60e - Claim For Refund Of Value Added Tax (vat) By An ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form VAT 60E - Claim For Refund Of Value Added Tax (VAT) online

Filing for a refund of Value Added Tax (VAT) can seem overwhelming, but with the right guidance, it becomes a straightforward process. This guide provides step-by-step instructions on how to complete Form VAT 60E online, ensuring that you have all the necessary details to submit your claim successfully.

Follow the steps to complete Form VAT 60E for your VAT refund claim.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

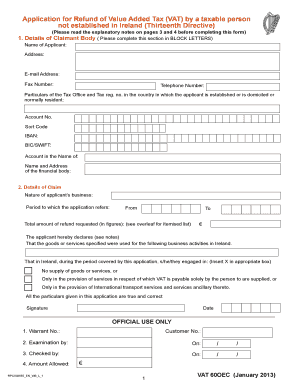

- Complete the details of the claimant body in BLOCK LETTERS. This includes providing your name, address, and contact information such as your email address, fax number, and telephone number.

- Provide particulars of the Tax Office and your Tax registration number in your country of establishment. Be sure to include your account number, sort code, IBAN, BIC/SWIFT, and the name of the financial body.

- Specify the details of your claim. State the nature of your business, the period to which the application refers, and the total amount of refund requested in figures.

- Indicate how the goods or services were used in your business activities in Ireland by checking the appropriate box regarding your supply of goods or services.

- Ensure that all particulars you have provided are true and correct. Remember to include the date and your signature.

- Attach supporting documentation, including original invoices showing the amount of VAT paid. Make sure the invoices have all the required particulars as listed in the instructions.

- Review your completed form for accuracy. Once satisfied, you can save changes, download, print, or share the completed form according to your needs.

Start your VAT refund claim process by completing your Form VAT 60E online today.

To claim a VAT refund in the US, you need to complete Form VAT 60E - Claim For Refund Of Value Added Tax (VAT) By An individual. Start by collecting all relevant receipts and documents that demonstrate your VAT payments. After filling out the form, submit it along with your documentation to the appropriate tax authority or service that manages VAT refunds. It's essential to follow the guidelines closely to ensure a smooth process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.