Get Request For Waiver Of The 2011 Tax Year Qualified Intermediary Audit Requirement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Waiver Of The 2011 Tax Year Qualified Intermediary Audit Requirement Form online

Filling out the Request For Waiver Of The 2011 Tax Year Qualified Intermediary Audit Requirement Form online can be straightforward with the right guidance. This guide will walk you through each section of the form to ensure that you complete it accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

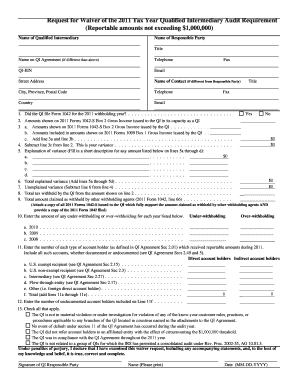

- In the first section, provide the name of the qualified intermediary and the responsible party. Ensure all names are spelled correctly and titles are filled in accurately.

- Input the telephone number and email address for the responsible party. This ensures that communication can occur efficiently.

- Fill in the street address, city, province, postal code, and country for the qualified intermediary. Double-check the accuracy of the address to avoid any correspondence issues.

- Indicate whether the qualified intermediary filed Form 1042 for the 2011 withholding year by selecting 'Yes' or 'No'.

- Complete section 2 by entering the amounts shown on 2011 Forms 1042-S Box 2 Gross Income issued to the qualified intermediary.

- For lines 3a and 3b, enter the respective gross income amounts issued by the qualified intermediary and included in Forms 1099.

- Calculate the total variance by following the prompts in sections 4 to 7. Ensure clear and correct calculations without omissions.

- In section 5, provide a brief explanation for any variance reported. Be precise and clear to support your claim.

- Review the total tax withheld as indicated in line 8 and ensure it matches your records.

- Attach copies of all supporting Forms 1042-S and the filed Form 1042 as required.

- Lastly, assess and check off all applicable statements in section 13. Ensure you understand the implications of your declarations.

- Sign and date the form at the bottom. Ensure that your signature matches the printed name for verification purposes.

- Once all fields are completed and reviewed, save your changes, and choose to download, print, or share the form as needed.

Get started and complete the Request For Waiver Of The 2011 Tax Year Qualified Intermediary Audit Requirement Form online today.

An IRS waiver is a formal agreement that releases a taxpayer from certain tax obligations, such as penalties or specific audit requirements. This waiver often requires the submission of a request, like the Request For Waiver Of The 2011 Tax Year Qualified Intermediary Audit Requirement Form. Understanding the conditions and requirements for a waiver can help you navigate your tax responsibilities more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.