Loading

Get Form 1096 - Pro Systems

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1096 - Pro Systems online

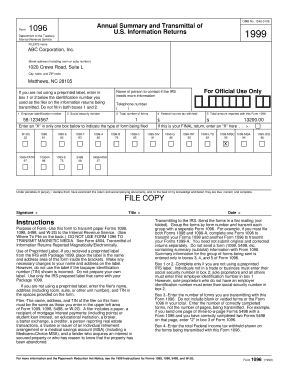

Filling out Form 1096 is essential for transmitting various types of U.S. information returns to the Internal Revenue Service. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out Form 1096 correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the filer’s name in the designated field. This should match the name used on the information returns being sent.

- Input the street address of the filer, including any room or suite number, in the appropriate section.

- Fill in the city, state, and ZIP code for the filer’s address.

- If not using a preprinted label, complete either box 1 or box 2 with the identification number you used for the information returns. If you are a sole proprietor without an employer identification number, enter your social security number in box 2.

- Provide the name and contact details of a person who can respond to inquiries from the IRS.

- Indicate the total number of forms being transmitted in box 3. Ensure this number reflects the correctly completed forms sent.

- In box 4, enter the total federal income tax withheld, as indicated on the forms being submitted.

- If applicable, mark the box indicating it is your final return.

- Sign the form in the designated signature area and provide your title below your signature.

- Review all entered information for accuracy before submitting your form. Save changes, download, print, or share the completed form as needed.

Complete your Form 1096 online today for a seamless filing experience.

Yes, you can file your 1096 electronically using IRS-approved software or e-filing services. This method is not only faster but also reduces the likelihood of errors compared to paper filing. Form 1096 - Pro Systems provides a seamless electronic filing solution for your convenience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.