Get Form 26qb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 26qb online

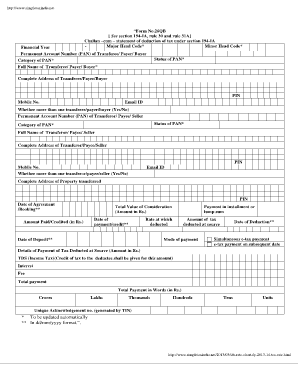

Filling out Form 26qb is an important task for users involved in property transactions, as it serves as a challan-cum-statement for tax deductions. This guide provides a clear and supportive walkthrough of how to complete the form online, ensuring that you understand each component and can complete it accurately.

Follow the steps to complete Form 26qb online easily

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the major head code and minor head code relevant to the transaction based on the guidelines provided.

- Specify the financial year during which the transaction took place.

- Provide the Permanent Account Number (PAN) of the transferee, payer, or buyer, ensuring it is accurate.

- Input the full name of the transferee, payer, or buyer as listed in official documents.

- Indicate the status of the PAN, and then fill out the complete address of the transferee, payer, or buyer, including the PIN code.

- Enter the mobile number and email ID of the transferee, payer, or buyer for communication purposes.

- Next, provide the PAN of the transferor, payee, or seller, along with their status and category of PAN.

- Complete the full name and address fields of the transferor, payee, or seller, along with their mobile number and PIN code.

- Indicate if there is more than one transferor, payee, or seller.

- Record the date of agreement or booking in the dd/mm/yyyy format.

- Specify the date of payment/credit and indicate if the payment was made in installments or as a lump sum.

- Enter the amount of tax deducted at source, and specify the mode of payment used for the tax.

- Complete the details of tax deducted at source including amounts for TDS, interest, and fees.

- Finally, review the total payments and ensure the complete payment amount is converted to words if required, then save your changes. You can download, print, or share the filled form as needed.

Complete your Form 26qb online today to ensure compliance and accuracy in your property transaction.

Form 26QB needs to be filed by any buyer who purchases property in India, regardless of their residency status. It is essential for ensuring that tax is deducted at source during the transaction. Additionally, anyone involved in property transactions, including non-resident buyers, must adhere to this requirement. Familiarizing yourself with Form 26QB can simplify your property dealings and ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.